Plan for tomorrow starting today

- Segragated Funds

- RRSPs

- RESPs

- RRIF & annuities

For more Information, contact your advisor

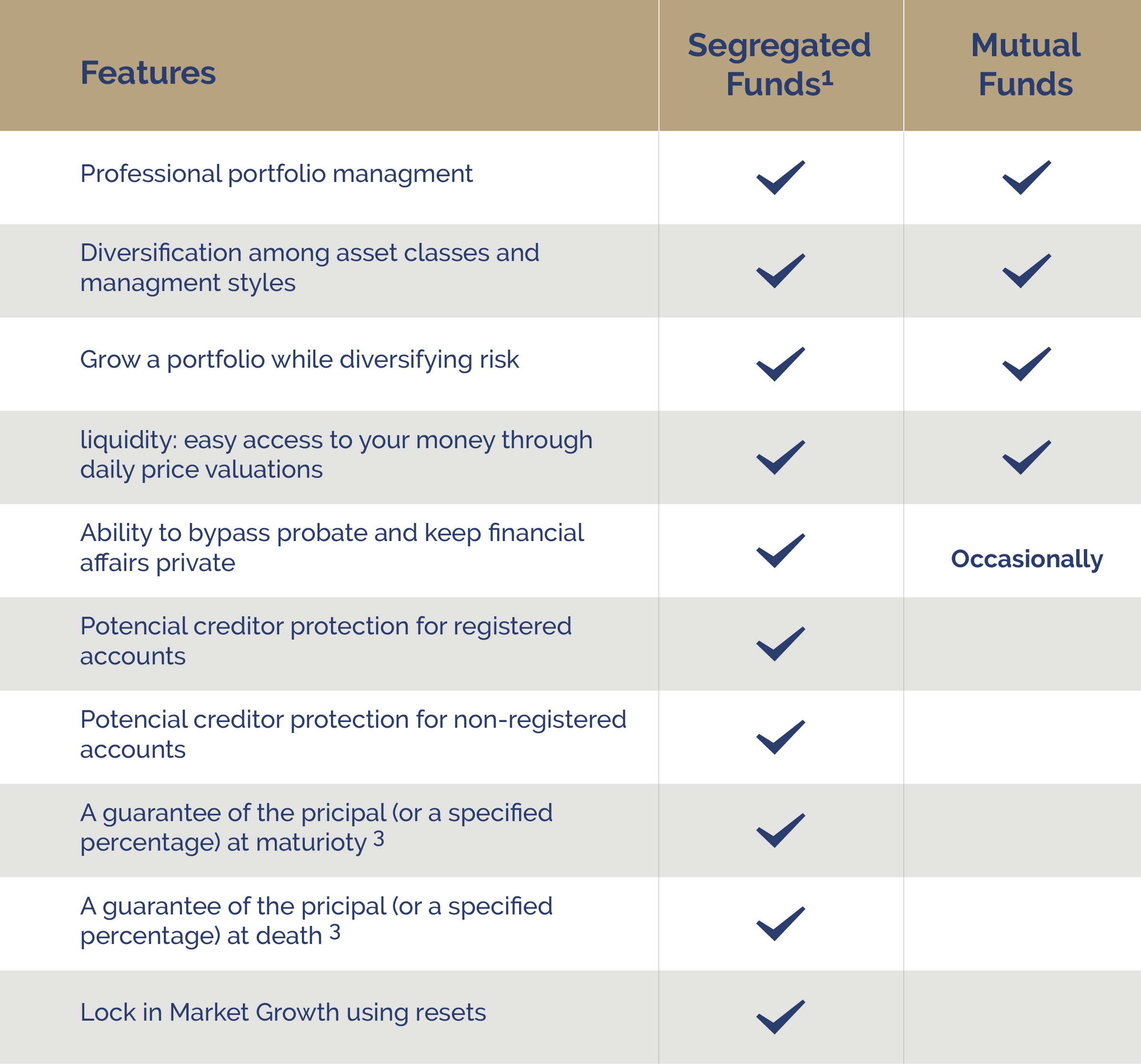

The main things to consider are when and how you want to use the funds. It’s also important to understand a few of the key differences between two options

RRSP

- Your contribution limit is based on a percentage of your annual income, up tp a specified maximum

- Contributions are tax-deductible.

- There is no tax payable on investment growth.

- Withdrawals are subject to income tax.

- Withdrawals may only be re-deposited if you have sufficient additional contribution room (unless funds are borrowed per the terms of the government’s Home Buyer’s Plan or Lifelong Learning Plan).

TFSA

- You may contribute $5,000 for each year from 2009 to 2012, $5,500 for 2013 and 2014, $10,000 for 2015 and 5,500 for 2016 and 2017.

- Contributions are not tax-deductible

- There is no tax payable on investment growth.

- Withdrawals are not subject to income tax

- Any withdrawals may be re-deposited in subsequent calendar years